The Negative Impact of the Ukraine War on the US Economy

Article Information

Marzieh Ronaghi1*, Eric Scorsone2

1Postdoc Researcher at the Department of Agricultural, Food, and Resource Economics, Michigan State University, USA

2Associate professor, Agriculture & Natural Resources Faculty, Department of Agricultural, Food, and Resource Economics, Michigan State University, USA

*Corresponding Author: Marzieh Ronaghi. Postdoc Researcher at the Department of Agricultural, Food, and Resource Economics, Michigan State University, USA.

Received: 25 April 2023; Accepted: 2 May 2023; Published: 27 June 2023

Citation: Marzieh Ronaghi, Eric Scorsone. The Negative Impact of the Ukraine War on the US Economy. Journal of Environmental Science and Public Health. 7 (2023): 111-122.

View / Download Pdf Share at FacebookAbstract

Russia's invasion of Ukraine has caused various political, humanitarian and economic crises around the world, and the economic consequences are now observed in the US, especially at gas stations. If the war continues, the United States will be prepared to resolve supply chain disruptions and limited resources (e.g. Wheat, oil, and natural gas) that could increase high inflation. The present study investigates the effects of the Russian war on the US economy using the three methods of Granger causality, Static and System of equations simultaneously with the aim of showing which of these three different approaches has a significant relationship with inflation and shows that both in the long-term (12 years) and in the short-term period, the relationship between gas price increase and inflation is emphasized. In the first two methods, Granger causality test and static test, in which the variable of number of corona patients, was included, showed that there is a significant relationship between the number of corona patients and the amount of carbon dioxide emissions; However, some results obtained in static and sure methods were different from the results of the Granger causality test. The research recommends that policymakers need to develop energy policies by considering the persistence of oil and gas prices on economic performance. In order to reduce the persistence of oil and gas price shocks on economic growth, the United States should use alternative energy sources for the long-term performance of its macroeconomics.

Keywords

Russia war crisis, Gas prices, Inflation, US economy

Russia war crisis articles; Gas prices articles; Inflation articles; US economy articles

Covid-19 articles Covid-19 Research articles Covid-19 review articles Covid-19 PubMed articles Covid-19 PubMed Central articles Covid-19 2023 articles Covid-19 2024 articles Covid-19 Scopus articles Covid-19 impact factor journals Covid-19 Scopus journals Covid-19 PubMed journals Covid-19 medical journals Covid-19 free journals Covid-19 best journals Covid-19 top journals Covid-19 free medical journals Covid-19 famous journals Covid-19 Google Scholar indexed journals Russia war crisis articles Russia war crisis Research articles Russia war crisis review articles Russia war crisis PubMed articles Russia war crisis PubMed Central articles Russia war crisis 2023 articles Russia war crisis 2024 articles Russia war crisis Scopus articles Russia war crisis impact factor journals Russia war crisis Scopus journals Russia war crisis PubMed journals Russia war crisis medical journals Russia war crisis free journals Russia war crisis best journals Russia war crisis top journals Russia war crisis free medical journals Russia war crisis famous journals Russia war crisis Google Scholar indexed journals Coronavirus articles Coronavirus Research articles Coronavirus review articles Coronavirus PubMed articles Coronavirus PubMed Central articles Coronavirus 2023 articles Coronavirus 2024 articles Coronavirus Scopus articles Coronavirus impact factor journals Coronavirus Scopus journals Coronavirus PubMed journals Coronavirus medical journals Coronavirus free journals Coronavirus best journals Coronavirus top journals Coronavirus free medical journals Coronavirus famous journals Coronavirus Google Scholar indexed journals Environment articles Environment Research articles Environment review articles Environment PubMed articles Environment PubMed Central articles Environment 2023 articles Environment 2024 articles Environment Scopus articles Environment impact factor journals Environment Scopus journals Environment PubMed journals Environment medical journals Environment free journals Environment best journals Environment top journals Environment free medical journals Environment famous journals Environment Google Scholar indexed journals Gas prices articles Gas prices Research articles Gas prices review articles Gas prices PubMed articles Gas prices PubMed Central articles Gas prices 2023 articles Gas prices 2024 articles Gas prices Scopus articles Gas prices impact factor journals Gas prices Scopus journals Gas prices PubMed journals Gas prices medical journals Gas prices free journals Gas prices best journals Gas prices top journals Gas prices free medical journals Gas prices famous journals Gas prices Google Scholar indexed journals pesticides articles pesticides Research articles pesticides review articles pesticides PubMed articles pesticides PubMed Central articles pesticides 2023 articles pesticides 2024 articles pesticides Scopus articles pesticides impact factor journals pesticides Scopus journals pesticides PubMed journals pesticides medical journals pesticides free journals pesticides best journals pesticides top journals pesticides free medical journals pesticides famous journals pesticides Google Scholar indexed journals vaccination articles vaccination Research articles vaccination review articles vaccination PubMed articles vaccination PubMed Central articles vaccination 2023 articles vaccination 2024 articles vaccination Scopus articles vaccination impact factor journals vaccination Scopus journals vaccination PubMed journals vaccination medical journals vaccination free journals vaccination best journals vaccination top journals vaccination free medical journals vaccination famous journals vaccination Google Scholar indexed journals greenhouse gas articles greenhouse gas Research articles greenhouse gas review articles greenhouse gas PubMed articles greenhouse gas PubMed Central articles greenhouse gas 2023 articles greenhouse gas 2024 articles greenhouse gas Scopus articles greenhouse gas impact factor journals greenhouse gas Scopus journals greenhouse gas PubMed journals greenhouse gas medical journals greenhouse gas free journals greenhouse gas best journals greenhouse gas top journals greenhouse gas free medical journals greenhouse gas famous journals greenhouse gas Google Scholar indexed journals Inflation articles Inflation Research articles Inflation review articles Inflation PubMed articles Inflation PubMed Central articles Inflation 2023 articles Inflation 2024 articles Inflation Scopus articles Inflation impact factor journals Inflation Scopus journals Inflation PubMed journals Inflation medical journals Inflation free journals Inflation best journals Inflation top journals Inflation free medical journals Inflation famous journals Inflation Google Scholar indexed journals Health articles Health Research articles Health review articles Health PubMed articles Health PubMed Central articles Health 2023 articles Health 2024 articles Health Scopus articles Health impact factor journals Health Scopus journals Health PubMed journals Health medical journals Health free journals Health best journals Health top journals Health free medical journals Health famous journals Health Google Scholar indexed journals

Article Details

1. Introduction

Recently, the world has encountered various crises. Although these crises have always existed during history, sometimes the simultaneous occurrence of several crises causes great damage to countries. These crises include the outbreak of Covid 19 and Russia's war with Ukraine. Russia's invasion of Ukraine has economic consequences in the US and around the world, exacerbates uncertainty, destabilize commodity markets, and inflation is potentially being increased as we encounter gas and food prices rise around the world. As Russia is a major producer of oil and natural gas [1], geopolitical conflicts have increased prices sharply in recent weeks. This country is also the world's largest exporter of wheat and a major supplier of food to Europe. The United States imports relatively little directly from Russia, but a recession caused by war can have devastating effects, temporarily raising the price of raw materials and final goods, as most countries in the world, including the United States, experience. High inflation and global unrest can also frighten American consumers and oblige them to reduce costs and other economic activities. Central banks also stated that geopolitical risks could increase global energy prices or exacerbate global supply shortages, as well as endangering growth prospects [2]. The potential economic consequences of the war are not obvious, but an external war could further delay recovery after two years of the coronavirus epidemic affecting the world and US economy. American consumers are currently dealing with rapidly rising prices, businesses attempt to improve disrupted supply chains, but people believe they are pessimistic about their financial future, despite strong economic growth [3]. Under these conditions, the economic uncertainty level is increased and it is negative for households and companies, and this effect is much felt in Europe and the US. As energy commodity markets are global, price changes in one part of the world affect the energy price in other parts of the world [4]. Oil may be the main story about the inflationary effects of the Russian war; however, it is not the only case. Ukraine is also a significant producer of uranium, titanium, iron ore, steel and ammonia and a major source of arable fields. The Ukraine invasion can increase global food prices, which were going to be stabilized after a considerable increase last year [5]. Russia and Ukraine together account for about 30 percent of world wheat exports, Ukraine alone exports more than 15 percent of corn around the world, and many of Ukraine's wheat and corn fields are near the Russian border [6]. Increasing gas and fertilizer prices, as well as drought and unsuitable weather in some areas, have led into the increase of world prices of wheat and other commodities [7]. Russia's invasion of Ukraine and the unprecedented sanctions imposed by the United States and its Western allies have shocked the global economy and financial markets. They have also diverted supply chains of vital food, energy and industrial products amid the increasing global inflation and caused more volatility to the stock market [8]. The United States has also encountered this crisis. The increase of gas price at gas stations and rising energy costs have made consumers in the United States dissatisfied as prices are increased and the economy growth is low [9]. Five impacts of Russia's war with Ukraine on the United States include [10].

1.1 Increasing energy and oil prices

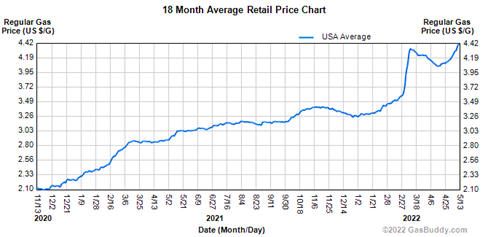

According to the US Energy Information Administration (EIA), Russia is the third largest supplier of foreign oil to the United States in 2020, accounting for 7% of imported oil. Russia also exported $ 13 billion of mineral fuel to the United States in 2019, accounting for more than half of all imports [11]. As shown in Figure 1, it is worth noting that prices are increasing, even if sanctions on Russia have so far excluded the energy sector.

Figure 1: US Retail Gas Price 2020-2022

1.2 Supply chain problems for farmers and rising food prices

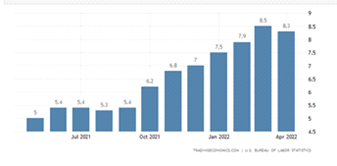

Farmers in the United States are being prepared to increase fertilizer prices, the price which was high before the invasion. Russia is the world's largest producer of low-cost, high-volume fertilizers, and also, it is the second largest producer of potash-a key nutrient being used in the products- in the world after Canada [12]. The most immediate effects of increasing fertilizer prices will be higher inflation in agricultural goods and, finally, food prices (figure 2). Americans should expect to pay more for food next year.

Figure 2: Inflation rate in the USA, 2020-2022

1.3 Travel restrictions and increasing cost of plane tickets

Ukraine has closed its airspace and a growing number of airlines have canceled flights outside Russia. Some countries, and the European Union, have closed their airspace to Russian aircraft. However, those traveling outside the conflict zone may be affected by this war. The crisis is likely to lead to high oil prices. Jet fuel is one of the largest expenses of an airline, so it is possible that high permanent fuel costs may result into higher fares (Orlando Airport [13]).

1.3 Stock market fluctuations

After Russian troops positioned on the Ukrainian border and markets were prepared for a major conflict, stocks have been steadily declining throughout the year. The war outbreak and unprecedented sanctions imposed on Russia could continue the sharp fluctuations as the effects of the financial sector spread to different countries [14].

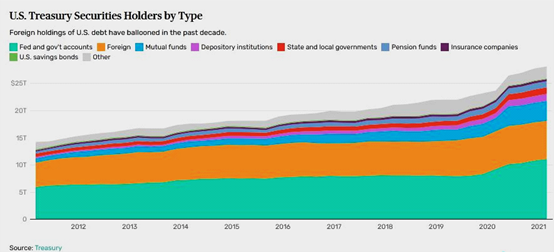

1.4 Sharp interest rate hikes by Federal Reserve

Higher energy and food prices and supply chain bottlenecks can increase inflation and force the Federal Reserve to accelerate interest rate hikes. Because of the fueling inflation of Ukraine war, as shown in Figure 3 the US government debt is huge due to increasing borrowing during the Corona pandemic [15]. The Federal Reserve raised interest rates several times this year after inflation was much higher than the bank expected. The prices rose 6.1 percent in the 12- month ending in January, according to the personal consumption expenditures (PCE) price index, the Federal Reserve's preferred index of inflation [16]. Due to the average GDP growth of 5.7 percent in 2021, it is predicted that the 4.3 percent growth in 2022 is decreased to 2.8 percent in 2023 and 2.3 percent in 2024 [17].

Figure 3: USA treasury 2010-2021

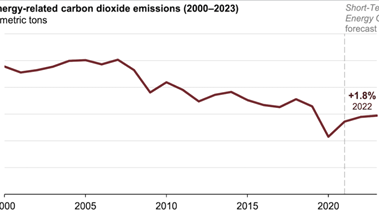

Another important issue in the Russia-Ukraine war is the environmental debate over soaring oil prices, which may be considered the only positive point of the war crises and the COVID 19 outbreak. As shown in Figure 4, since the Corona outbreak, we have observed a reduction in environmental pollution with job closures and remote working. Now, with the war crisis, oil prices, which have reached their highest level since 2008, can truly cause disruption as it increases the tendency towards less gas-consuming vehicles and, over time, the demand for fuel-efficient vehicles is reduced and this issue can have a significant impact on CO2 reduction in the future [18]. The 2022 annual energy outlook predicts that energy-related carbon dioxide emissions in the United States will decrease by the mid-2030s and then increase by 2050 based on a wide range of hypotheses [19].

Figure 4: Carbon dioxide emissions in the United States from 2000-2023. (In million tons of carbon dioxide)

With Corona crisis control and the impacts of the Ukraine-Russia war, especially rising gas prices, the investigation of the economic situation in the US, which ranks first in the number of coronavirus patients and second in CO2 emission, has become much more emphasized. Although several studies have examined the effects of economic factors on CO2 emissions [20,21,22,23], none of these studies have simultaneously focused on the increasing gas prices during war and the impact of the corona outbreak on CO2 emissions and other economic factors. Considering the pollution of the US as the second country with the highest CO2 emissions, the present study fills the gap by investigating the impact of the corona pandemic on CO2 emissions and other economic factors, as well as gas prices soar due to the Ukraine-Russia war.

2. Literature review:

The latest economic forecast for the US shows that the new Russia-Ukraine war is already hitting the world economy. The war has led to a significant increase in federal defense spending, not only because of the current conflict between Russia and Ukraine, but also because of the possibility that this war is spreading to other countries [24]. War and the reduction of the corona epidemic, emphasizes the consistency of economic factors. Recovery and returning to normal activities with corona control requires resuming decline in service costs and lower commodity costs, which in turn reduces pressure on supply chains and reduces inflation. While the final recovery has not yet occurred, the Ukraine-Russia war has derailed the assumptions of reducing inflation, and the economic predictions have encountered considerable uncertainty. This forecast mostly depends on the future trend of the Corona epidemic, as well as how long the war between Russia and Ukraine will last and whether the war will affect other countries or not. These are the immediate dangers facing the US, which exacerbate the dangers of global climate change and political divisions in the United States [24]. As higher oil and energy prices are observed as key drivers of inflation, Inflation is still a concern. In the early stage of pandemic, the US oil production decreased in response to lower demand, stay-at-home orders and low demand of travel. When people started going out again, demand was increased, but oil supply did not continue rapidly. In a study done by [25], the time-varying effects of oil price shocks on financial intermediation (credit market) and inflation as a channel of transmission in the US: Oil supply, aggregate demand, domestic demand and oil-specific demand shocks. The results showed an increasing response of financial intermediation to oil supply. Besides, the response of credit markets to aggregate demand shocks during the Covid-19 epidemic is different from that observed during the subprime crisis. They also indicated that the inflation response influences the credit market reaction to aggregate and domestic demand shocks.

Another study conducted by [26] investigated the relationship between energy prices and economic growth. Their study was conducted in 18 OECD countries. They suggested that a 10 % increase in energy prices reduced economic growth by about 0.15 %. In addition, there exists evidence that this response may be greater for energy-intensive economies. In this regard [27] examined the relationship between energy prices and economic growth using Granger causality and Toda-Yamamoto causality in Turkey. They showed that the Granger causality test results and the frequency domain have an insignificant causal relationship between the variables. However, according to the results of the Toda-Yamamoto causality test with a structural break, there is a causality relationship between oil-gas prices and economic growth. Another important effect of rising energy prices is the impact on CO2 emissions and environmental pollution [28]. investigated the impact of energy prices on CO2 emissions in China based on STIRPAT (stochastic impacts by regression on population, affluence and technology) structural human ecology model. Their results showed that energy prices has a significant negative effect on CO2 emissions after controlling other economic and energy market factors and spatial correlations of these variables. The paper highlighted the role of energy market in reducing CO2 emissions and improving sustainable economic development. Another important issue in the last two years is the Corona pandemic issue and its economic and environmental impact [29] examined measures to curb the prevalence of COVID-19 in 2020 and its impact on the sudden decline in human CO2 emissions in urban areas in 11 European cities. It was found that during the first quarantine, urban CO2 emissions were declined by 5 to 87 percent across the studied areas over the same period in previous years, mostly due to transportation restrictions. However, with restrictions lifted in the following months, greenhouse gas emissions quickly returned to pre-Covid levels in most cities. Another similar study done by [30] examined greenhouse gas and NOx emissions in the US electricity sector during the corona outbreak. They showed that in April 2020, COVID-19 social constraints in the US led to a decline in electricity demand from the commercial and industrial sectors. It was found that changes in Covid's electricity demand from March to June 2020, with electricity demand generally reaching 2015-2019 levels starting in July 2020. They found that CO2 emissions in the US electricity sector, reported by the EPA, were 29.8 (MTCO2). Other impacts of the corona outbreak have been economic impacts, especially unemployment.[31,32,33,34,35] modeled the macroeconomic and distributional consequences of quarantine shocks during the COVID-19 pandemic. They indicated that job loss prevents equivalent to 6.5 percent of sustainable employment. Another similar study done by [36] analyzed the effects of COVID-19 on employment and unemployment in the US. He combined geospatial science with the exploration of social factors across counties in Tennessee which is part of coronavirus "red zone" states in the United States southern Sunbelt region. The negative impact of social harm on the economic consequences of the pandemic was supported by several lines of evidence. He indicated that urban and rural areas may be vulnerable to the broad social and economic damage. The study contributed to current research on economic impacts of the COVID-19 outbreak and the social distribution of economic vulnerability. Also, [37] investigated the health, economic and environmental impacts of COVID-19. The results of the study showed that although COVID-19 has given the earth an opportunity to restore its ecosystem, its role in bringing change in every sector including socio-economic is great. The shutting down of industry has led to job losses and badly affected economic sector. Nearly 20 million workers lost their jobs in Bangladesh in the informal sector. In addition, corona virus has endangered the agricultural sector, with 66 percent of farmers (53 % crops and vegetables, 99 % fish farmers) acquired lower prices than their prices in the past under normal situation. Together with government, non-governmental organizations, researchers, doctors, craftsmen, international organizations as well as individuals should come along to manage this pandemic. As mentioned, studies over the past two years have investigated the impacts of COVID-19 on economic activity and greenhouse gas emissions. In general, the importance and consequences of Quarantine measures have not yet well understood [38] that the world has encountered a crisis of war between Ukraine and Russia. The economic and political consequences of this war have affected many countries. As we investigated, a few studies have been performed about the combined impact of the Russian war crisis and the Corona outbreak on the US. This study examined the impacts of COVID-19 on global carbon dioxide emissions as well as the impact of rising gas prices and inflation caused by the Ukraine war on other economic factors during 2000 to 2022 with three US economic methods and compared their results. . Therefore, the main purposes of this study are: (1) to examine the effects of quarantine measures due to the COVID-19 pandemic on annual CO2 emissions and unemployment (2) to increase gas prices due to the Ukrainian war on GDP and inflation in the US. Introduction of model, variables and statistical sources. When the US economy was prepared to recover after the Corona pandemic, Russia's invasion of Ukraine caused a new sense of uncertainty and danger in the forecasts, along with concerns about a new world order which is still unclear [39]. As production and employment have largely recovered after pandemic, the United States has encountered economic turmoil. The combined with the current geopolitical conflict, poses significant risks for recovery. As supply shocks intensify with the Russia-Ukraine war, and inflation is soaring, the Federal Reserve now has encountered the difficult challenge of recovering the economy to curb inflation without sacrificing employment and production [24]. Many distributors have reduced their purchases of Russian oil, but oil prices are expected to remain high and this increases inflation in at least the second quarter of 2022 [24]. This study attempts to examine the effects of the Russian war as well as the corona consequences on the American economy. Based on experimental studies and theoretical basics, the following variables are defined in Equation 1 as follows:

lnGDPit =a +a1 lnFIit +a2 lnGDit +a3 lnUEit +a4 lnEXit+ a5 lnIMit +a6 lnINit+ a7 lnCO2it + (1)

a8 lnCOVit+a9 lnGASt+ uit

GDP, (IN) inflation, (FI) foreign investment, (GD) government debt, (EX) exports and (UE) unemployment, (IM) imports, (CO2) carbon dioxide emissions, (GAS) gas price, (COV) corona cases and uit is a disturbance.

Also, in order to study the effect of variables of foreign investment, inflation, exports, imports, government debt and GDP in the United States, on the increase in gas prices, CO2 emissions and unemployment, a set of equations was estimated as follows:

lnCO2it =b0 +b1 lnGDPit +b2 lnEXit + b3lnUEit +b4 lnIMit +b5 lnGASt + b6 lnCOVit +€it (2)

lnUEit =g0 +g1 lnGDPit +g2 ln IMit +g3 ln GDit +g4 lnINit +g5 lnCO2it +jit (3)

lnGASt =α0 + α1 lnFIit + α 2 ln IMit + α 3 ln GDit + α 4 lnINit +òit (4)

Equation (1) estimates the effect of foreign investment, government debt, unemployment, exports, imports, inflation, carbon dioxide emissions, corona patients, and the effect of rising gas prices on GDP. Equation (2) estimated the effect of exports, imports, unemployment rate, corona cases and gas price on CO2 emissions. In Equation (3), inflation, government debt, GDP, carbon dioxide emissions, and imports were estimated on unemployment. Equation (4) also estimated the amount of foreign investment, imports, inflation and government debt on gas price. The description of the variables in Table 1 is as follows.

Table 1: The Descriptive Statistics of Model Variables

|

Variable |

Maximum |

Minimum |

Standard Deviation |

Mean |

|

CO2 emissions(metric tons per capita) |

5.77 |

1.7 |

4.60e |

1.65e |

|

Inflation |

0.9 |

-0.003 |

0.02 |

0.02 |

|

Unemployment |

0.09 |

0.03 |

0.01 |

0.05 |

|

Government Debt |

1.38 |

0.038 |

0.26 |

0.73 |

|

Gas Price |

4.21 |

1.43 |

0.84 |

2.68 |

|

GDP growth |

2.93e |

1.03e |

4.06e |

1.65e |

|

Export |

14.11 |

9.03 |

1.55 |

11.63 |

|

Import |

4.28e |

1.76e |

0.87 |

1.45 |

|

FDI |

52.22 |

13.24 |

7.70e |

3.16e |

|

Covid case |

73728 |

23455 |

26460 |

43819 |

Source: Research findings

2.1 Model estimation method

In this study, as the Corona outbreak crisis and the Russia-Ukraine war were occurred in recent year, GAMS software was used to estimate the equation in static mode. In static analysis, time is ignored. In other words, the time path of the variables is not included in the discussion. In this method, the year of the combined crises of the Russian war and the COVID outbreak was considered as a base year to examine the combined impact of the increase in gasoline prices due to the war as well as the impact of the corona outbreak simultaneously. The simultaneous equations model in the US for the period 2000-2022 was used. The required data were obtained from the World Bank and the trade economy for the United States. Many economic equations can be explained by single-equation models. In the Granger causality test, the statistical hypothesis is used for determining causality between time series. This test is based on the principle that the "cause precedes its effect in terms of time" .Therefore, whenever the past values of the time series Xt help significantly in predicting the future values of the other time series Yt, more than what the past values of Yt itself can help, we say that process x is the cause of process Y [40]. In these models, a variable is considered as a function of one or more variables and the causal relationship between the two variables is examined. However, there are cases where there is a bidirectional causality between economic variables. It means, the economic variable, by affecting another economic variable, is affected by it [40]. When a dependent variable in one equation is an explanatory variable in another equation, it is called a pattern or system of simultaneous equations. For each endogenous variable of the system, there is a behavioral or structural equation. However, in some system models, there is no internal dependence between endogenous variables and there is a one-way causal relationship between endogenous variables. In other words, each equation represents a one-way causal Y independence. Thus, for example, Y1 affects Y21 but Y2 does not affect Y1. Similarly, Y1 affects Y3 and Y2, Y doesn’t affect Y3 itself. This is called causal models. Due to the lack of independence between the endogenous explanatory variables and the residuals, the OLS method is unsuitable for estimating an equation in a simultaneous system, and biased and inconsistent estimators are obtained. Therefore, the use of seemingly unrelated regression (SUR) is suitable. A seemingly unrelated system is a combination of several separate (single) relationships that are related to each other based on the correlation of their disturbance components [34].The two advantages of the SUR method are: First, it provides an efficiency estimate based on a combination of information from different equations. Second, it also takes into account the constraints that include the parameters of the various equations. According to the relationships presented in the previous section, the model of this research is in the form of causal models. The sur method has also been chosen to estimate the model due to its advantages. Before the model estimation, we examine the studied data statically. The use of traditional and conventional econometric methods in model estimation using time series data is based on the assumption that the model variables are stationary. If non-stationary data are used in estimating econometric equations, as mean, variance and covariance are not time independent, the F and t tests as well as the statistical inference are not valid and if the non-stationary time series variables are used in estimating the model coefficients, the result may be spurious regression [41]. In these regressions, although there may be no conceptual relationship between the model variables, the coefficient of determination R2 obtained may be very high and cause the researcher to make erroneous inferences about the relationship between the variables. So, the first step for econometric analysis is to determine the degree of co-integration (number of unit roots). Some variables may be stationary or non-stationary in the process (i.e. (I0 after controlling the effect of the definitive trend)). The non-stationary variables that are turned into stationary variables after one difference are called first order co-integration or (I1). Some variables can be stationary by more than one differencing, so they are called integration order I(d). There are several methods to investigate the statics of variables, but the Augmented Dickey-Fuller (ADF) method is more common than other methods [42]. The results of the Breusch-Pagan test showed non-auto correlation. Based on the F statistic, the null hypothesis that all coefficients are zero at the 1% significance level has been rejected. As a result, the validity of the estimated coefficients has been verified.

Time series analysis is as follows:

In general, if the equation does not have intercept and trend, it is as follows:

?Xt =δXt+ ?Xt-j+1 +εt

And if the equation has both the intercept and the trend, it is expressed as:

?Xt = α+βt +δXt+ ?Xt-j+1 +εt

The nine-step static test is performed as follows:

Step 1: The philosophy is from top to bottom in such a way that the starting point of the method is a very general state, that is, it has both a trend and intercept, and moves step by step to a specific state at the end of the method.

Step 2: If the studied series includes the intercept or trend, the test of the null hypothesis of the existence of a unit root in that series can be done with a standard normal explanation, i.e Z=δ /s E δ and if lzl, the H0 is rejected.

Step 3: Because the unit root test has little power to reject H0 hypothesis, at each stage of the sequential method, if H0 is rejected, it stops the test at each stage and concludes that the studied time series is static.

The unit root test in an Xt time series is as follows:

?Xt = α+βt +δXt+ ?Xt-j+1 +εt

?Xt is a dependent variable and the number of lags is determined using Akaic (AIC) and Schwartz statistics and the autocorrelation in residual terms is determined by LM test.

Then t = δ / sEδ is obtained and is compared with TT in the table of critical values. If |TT|>|t| H0 is not rejected and the studied time series Xt has unit root and the time series is non-stationary.

H0: δ=0

Step 4: In this step, tα = α / sEα should be compared with Tαt in the table of critical values.

H0: α=0 given that δ=0

|tα|< |TαT| →α=0

Step 5: When H0: α = 0 is not rejected, the test equation must be changed so that the equation has an intercept, but no trend:

?Xt = α +δXt+ ?Xt-j+1 +εt

Step 6: Perform all the previous steps for this equation. In this step, compare the tδ = δ / sEδ with Tμ in the table of critical values as follows:

H0: δ=0

|tα|< |Tμ| →δ=0

If H0 is not rejected, the δ = 0 test must be performed with the standard normal to determine that α is significant.

Step 7: In this step, compare the value of tα = α / sEα with Tαμ in the table of critical values:

H0: α=0

→α=0 Tαμ|| |tα|<

Step 8: When α = 0 is not rejected, change the equation so that it is without intercept and trend.

?Xt = δXt+ ?Xt-j+1 +εt

Step 9: In this step, compare the value of tδ = δ / sEδ with T in the table of critical values:

H0:δ=0

|tδ|< |T| →δ=0

In this case, H0 is not rejected and Xt is non-stationary and has a unit root and is a random step without intercept and trend.

As it was mentioned, in Table 2, we examine the static variables of the model using the above method.

Table 2: Static results of model variables

|

Variable |

Static state |

Prob |

|

GDP |

I(0), Trend and intercept |

0.006 |

|

CO2 |

I(1), None |

0.03 |

|

GAS |

I(1), Trend and intercept |

0.005 |

|

GD |

I(1), Trend and intercept |

0.04 |

|

Ex |

I(1), Trend and intercept |

0.01 |

|

IM |

I(1), Intercept |

0.04 |

|

IN |

I(1), Trend and intercept |

0.02 |

|

UE |

I(1), Trend and intercept |

0.03 |

|

FI |

I(0), None |

0.03 |

Source: Research findings

Estimation of models and results interpretation:

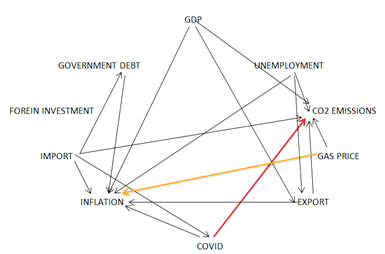

In this study, first, a general image of the relationships between variables was drawn using the Granger causality relationship. As can be seen in Figure (5), there is a causal relationship between the variables of rising gas prices with inflation and also between the number of coronary patients with increasing carbon dioxide gas. However, since the effect amount and the positive or negative sign of the effect are not specified in the causal relationship, the relations between the variables were estimated more accurately using the static estimation relation by GAMS and also using the SUR model. The comparison of the results was investigated in three methods.

Figure 5: Relationship between the ten Variables with Granger Causality Test

GAMS software was used to estimate the equation in static mode without considering time. In this method, the year of crises with the effects of the Russia-Ukraine war on the US and the COVID outbreak was considered as a base year and the combined effect of rising gas prices due to the war on economic factors and the impact of the corona outbreak on reducing carbon dioxide emissions and GDP was investigated.

Table 3: Results of model variables and parameters using GAMS software in 2022

|

Equation 1 |

Coef |

Equation 2 |

Coef |

Equation 3 |

Coef |

Equation 4 |

Coef |

|

VARIABLE a1.L |

342 |

VARIABLE b1.L |

396 |

VARIABLE g1.L |

170 |

VARIABLE g1.L |

168 |

|

VARIABLE a2.L |

329 |

VARIABLE b2.L |

228 |

VARIABLE g2.L |

222 |

VARIABLE g2.L |

214 |

|

VARIABLE a3.L |

141 |

VARIABLE b3.L |

210 |

VARIABLE g3.L |

223 |

VARIABLE g3.L |

362 |

|

VARIABLE a4.L |

318 |

VARIABLE b4.L |

194 |

VARIABLE g4.L |

114 |

VARIABLE g4.L |

386 |

|

VARIABLE a5.L |

342 |

VARIABLE b5.L |

346 |

VARIABLE g5.L |

208 |

||

|

VARIABLE a6.L |

418 |

VARIABLE b6.L |

402 |

||||

|

VARIABLE a7.L |

246 |

||||||

|

VARIABLE a8.L |

409 |

||||||

|

VARIABLE a9.L |

384 |

||||||

|

PARAMETER R2 |

0.35 |

||||||

|

PARAMETER TSS |

398 |

||||||

|

PARAMETER RSS |

257 |

||||||

|

PARAMETER ESS |

141 |

||||||

|

PARAMETER F |

408 |

Source: Research findings

As shown in Table (3), in the first equation, the largest coefficient is related to the inflation rate, the increase in gas prices, as well as the number of coronary patients who affect GDP. Considering the recent two crises in the United States, the results seem logical. Inflation caused by the Ukraine-Russia war had a significant impact on GDP in the United States [43].The Corona pandemic, the shutting down of many businesses, and widespread social restrictions that led to decreasing urban and interurban traffic also had a significant impact on the decline in the US GDP index. As can be seen, these results were not exactly observed in Granger causality relationship. In this equation R2 = 0.35. The coefficient of determination R2 shows the ratio of the total change of the dependent variable (around its mean) explained by the change of the independent variables and is always ranging between zero and one.

R2 is a non-reducing function of the model independent variables. Because by adding the number of independent variables RSS, i.e. the residual sum of squares decreases and R2 increases, dependent variables do not necessarily increase the explanatory power of the dependent variable. Generally, the general explanatory power of regression can be measured by analysis of variance. F-statistic is used in analysis of variance. In regression, the F statistic is used to test the null hypothesis that all regression coefficients are equal to zero at the same time, as opposed to the hypothesis that not all of these coefficients are equal to zero. In the second equation, the largest coefficient is related to the number of patients with Corona virus. This means that as the number of corona cases is increased, the quarantine restrictions are also increased to control the disease, leading to the loss of some jobs and reduced transportation, reduced production, and reduced CO2 emissions. With the increase of mortality and the spread of the virus around the world, energy demand patterns have changed dramatically around the world. Many oversea trips were canceled due to the closure of countries' borders, and people stayed at home to avoid spreading this dangerous disease. During the lock down of people, urban traffic and the carbon dioxide produced by vehicles were decreased [44]. In the third equation, the amount of government debt has a higher coefficient, which means that increasing government debt has a significant impact on unemployment. The higher the government debt, the less investment is made in employment and unemployment is increased [45]. The US government debt rises sharply due to high borrowing during Corona pandemic. $ 30 trillion debt was due to government plans for Corona pandemic leading to the extended unemployment benefits, financial support for small businesses and paying the wages. All these plans were paid by borrowing [46]. This result was not exactly observed in Granger causality relationship.

In the fourth equation, the increase in inflation due to the Russia-Ukraine war increased the gas price in the US, which is reflected in the coefficients of the fourth equation [47]. Increasing energy prices led to rising costs of transporting goods and parts across the US economy, which in turn contributed to increasing prices for consumers. With the continuance of the Russia-Ukraine war and approaching the season in which gas price is increased, Americans should be prepared to pay higher prices for fuel. This was also a clear result of the Granger causality model. The results of estimating the parameters of the system of simultaneous equations are as follows: It is worth to mention that due to the absence of the patients with Corona Virus in the years before 2020, this variable was not considered in simultaneous equations and considering the fact that the study has focused on the amount of CO2 emission and rising gas price, the equations 2-4 are estimated as simultaneous equations system:

Table 4: Results of simultaneous equation system (2000-2022)

|

Variable\ Dependent |

-2 |

-3 |

-4 |

|

Independent variable |

LnCO2 |

lnUE |

lnGAS |

|

lnGDP |

1.15* |

-1.20 |

- |

|

(2.33) |

(-7.93) |

||

|

lnUE |

11.69 |

- |

- |

|

(1.26) |

|||

|

lnEX |

0.43* |

- |

- |

|

(2.24) |

|||

|

lnFI |

- |

- |

-9.05 |

|

(-0.93) |

|||

|

lnIM |

5.96 |

2.92* |

1.17* |

|

(1.72) |

(6.57) |

(4.92) |

|

|

lnIN |

- |

0.17 |

**13.46 |

|

(1.32) |

(1.99) |

||

|

ln GAS |

0.49 |

- |

- |

|

(1.46) |

|||

|

InGD |

- |

*0.11 |

-1.36 |

|

(5.19) |

(-1.79) |

||

|

In CO2 |

- |

8.62 |

- |

|

(1.53) |

|||

|

The The numbers in parentheses show the Z-statistic of coefficients***,**, * ***,**, * and % represents a significant level of 1% and 5% and 10%. |

|||

As shown in table (4) the first regression is related to CO2 emissions. GDP growth has a positive and significant effect on the dependent variable. It means that increasing production is accompanied by increasing the work of factories and industry, which increases more energy fuel and increases carbon dioxide [48]. Exports also have a significant and positive effect with the increase in carbon dioxide. In other words, it is accompanied by an increase in exports along with an increase in production and an increase in the use of special containers and preservatives, which leads to an increase in carbon dioxide emissions [49,50]. The variables of rising gas prices and imports do not have enough of a significant effect on carbon dioxide emissions in equation 2. Whereas in the previous two methods, there was a significant relationship between the increase in gas prices and carbon dioxide emissions. In the third equation, GDP, imports and government debt have a significant relationship with unemployment. In other words, increasing GDP is associated with increased labor use, which reduces unemployment [51]. Increasing imports reduces the use of labor and increases unemployment, and on the other hand, increasing government debt has a positive relationship with unemployment. While there was no relationship between GDP and government debt with unemployment in the Granger causality method. In the fourth equation, increasing inflation and increasing imports have a positive and significant relationship with increasing gas prices. As we saw in 2022, the increase in inflation caused by the war had a significant impact with the increase in gas prices. Oil prices and inflation are historically related; This is because higher energy prices increase the cost of transportation and production and increase the price of goods and services [52]. This phenomenon is called "secondary effects". However, the price of gas, beyond its role as a factor in inflation, is now important in another way; During this period, the factors that created inflationary trends are different from the past. Unlike before, most of the problems are related to global distribution, exports and imports (shortage of goods and raw materials due to the corona epidemic), which have caused the current inflation, not the fluctuations in demand. This has made traditional central bank tools to control inflation ineffective. As a result, controlling gas prices as a means of controlling inflation becomes even more important [53]. If gas prices remain high, it could increase existing inflationary pressures and have secondary effects with economic and political consequences. There was no relationship between rising gas prices and imports in the Granger causality method.

Recommendations:

The present study examined the relationship between gas price index and GDP, the number of Corona patients, CO2 emissions and several other economic factors in the period 2022-2000 in the US.

The analysis was evaluated based on three different approaches. Therefore, this study was conducted to show which of these three different approaches generates more accurate results. The first case of these approaches is the Granger causality test. It was found that based on the Granger causality test, there is no causal relationship between many variables, the most important of which is the relationship between gas prices and GDP. The most important case to consider is the loss of information due to not paying attention to many time series attributes of the variables and the differences between the variables.

In all three Granger causality methods, static test and SUR model , the variable rising gas price has a significant relationship with inflation and show that both in the long-term (12-year period )and in the short-term period, the relationship between gas price and inflation is emphasized. In the first two methods, Granger causality test and static test, which included the variable number of corona patients, showed that there is a significant relationship between the number of corona patients and the amount of carbon dioxide emissions. However, some results obtained in static and SUR methods were different from the results of the Granger causality test. It can be observed that the findings of different studies on the effects of changes in gas prices on GDP are different. Generally, the findings are based on the effect of gas prices on economic performance in most studies. The finding that gas prices affect economic performance is consistent with previous research in the literature performed by [54, 55, 56, 57, 58]. However, the important point is also related to the methodology used in this study. In particular, this paper was conducted with the aim of emphasizing the permanence of the obtained relationship. It is economically significant that rising gas prices in the United States will influence inflation and GDP both in the long run and in the short run. Economic and political views on oil and gas prices, which have a significant effect on inflation, are crucial. The changes in oil and gas prices affect oil production and the non-oil sector. In addition, energy imports, along with fluctuations in oil and gas prices, have made many of the country's macroeconomic performance indicators more fragile [27]. In this case, the shock to oil and gas prices may have a permanent effect. It can also be stated as another result that lower oil and gas prices may have a positive impact on some economic factors. With the emergence of COVID-19 in China, the sharp decline in oil and gas prices has a positive effect on economic performance in the countries that import energy in the short run, but it did not last long. Now, given the effects of the Ukraine war and the unprecedented rise in gas prices in the US, how long these conditions will be permanent or temporary is certainly controversial and the subject of other studies. Therefore, policymakers need to develop energy policies by considering the persistence of oil and gas prices over economic performance. In order to reduce the persistence of oil and gas price shocks on economic growth, the US should choose alternative energy sources for the long-term performance of its macroeconomics. The effects of oil and gas prices are not limited to the economic field. Whether the impact of oil and gas prices on other social, political, and environmental fields is permanent or not, is an important research topic for future studies.

Author Contributions:

Marzieh Ronaghi is the first author of this article. Marzieh Ronaghi is a Postdoc Researcher at the Michigan State University and she wrote this article. All authors read and approved the final manuscript.

- The authors declare that there is no conflict of interest regarding the publication of this paper.

- This paper is self-funded.

- The data used in this paper is available.

- STATA and GAMS software is used in this manuscript.

Declarations:

Availability of data and materials

The required information and data are collected and STATA software is used to analyze the econometric model. In this paper, we use time series ans static data . This study covers annual data for 2011-2022 in the USA.

Funding:

This paper is self-funded.

References

- US Energy information administration (2022). https://www.eia.gov/outlooks/steo/

- US Energy (2021).

- Detmeister A, Lebow D, Peneva E. Inflation Perceptions and Inflation Expectations. FEDS Notes (2017): 1-22.

- DeHaan P. Are gasoline prices finally falling? Reuters (2022).

- International Monetary Fund (2022). https://blogs.imf.org/bloggers/christian-bogmans/

- World data center (2022). http://wdc.org.ua/en/node/29"29

- WILL D. UBS predicts inflation has peaked, but warns that March’s consumer price index will still be really nasty. Finance, Inflation. Finance (2022): 1-20.

- Levy Ph. Alarm Bell Rings - Flexport Weekly Economic Report (2022).

- Shepherdson I. 27 May 2022 Consumption Jumped in April while Core PCE Inflation Fell; but How Far. US Publications (2022).

- LANE S, RAI S. Five ways the Russian invasion of Ukraine could impact the US economy. Business (2022): 1-10.

- American Automobile Association 28 (2022)

- 12-Bloomberg (2022). https://www.bloomberg.com/

- Orlando Airport (MCO) (2022).

- Bell L. Market Uncertainty (2022). https://www.ally.com/do-it-right/trends/weekly-viewpoint-may-

- US treasury (2021).

- Mericle D. A Recession Is Not Inevitable (2022).

- Federal Reserve (2022). https://www.info.com/ federal

- Environmental defense fund (2022).

- Annual Energy Outlook (2022). https://www.eia.gov/outlooks/aeo/

- Ronaghi M, Reed M, Saghaian S. The impact of economic factors and governance on greenhouse gas emission, Environ. Econ. Pol. Stud 22 (2019): 153-172.

- Reed M, Saghaian M, Ronaghi M. The Effects of Good Governance on the Agricultural Sector. International Journal of Agriculture and Environmental Research 6 (2020): 2-20.

- Cru L, Thiago A, Almeida N, et al. Economic growth and environmental impacts. An analysis based on a composite index of environmental damage. Ecological Indicators 76 (2017): 119-130.

- Zhou SH. Environmental, Social and Governance reporting in China. Social and Environmental Accountability Journal 36 (2016): 82-93.

- Feler l. NATIONAL ECONOMIC OUTLOOK FOR 2022.Scince Direct (2022).

- Boufateh T, Saadaouib Z. The time-varying responses of financial intermediation and inflation to oil supply and demand shocks in the US: Evidence from. Energy Economics 102 (2021): 35-55.

- Huntington H, Liddle B. How energy prices shape OECD economic. Energy Economics 111 (2022): 60-82.

- K?rca M, Canbay S, Pirali K. Is the relationship between oil-gas price index and economic growth in Turkey permanent? Resources Policy 69 (2020): 18-38.

- Li K, Fang L, He L. The impact of energy price on CO2 emissions in China: A spatial econometric analysis. Science of The Total Environment 706 (2019): 42-59.

- Nicolinia G, Antoniella G, Carotenuto F, et al. Direct observations of CO2 emission reductions due to COVID-19 lockdown across European urban districts. Science of The Total Environment 830 (2022): 46-62.

- Ahn DY, Salawitcha RJ, Canty Tp, et al. The U.S. power sector emissions of CO2 and NOx during 2020: Separating the impact of the COVID-19 lockdowns from the weather and decreasing coal in fuel-mix profile 14 (2022): 1-68.

- Graham J, Ozbilginb M. Age, industry, and unemployment risk during a pandemic lockdown. Journal of Economic Dynamics and Control 133 (2021): 42-33.

- Ronaghi M, Scorsone E. The Impact of Governance, Education, Smoking, and Drugs on Sexual Violence in The Universities.The USA. Arch Epidemiol Pub Health Res 2 (2023): 172-182.

- Ronaghi M, Scorsone E. The Impact of Governance on Poverty and Unemployment Control Before and After the Covid Outbreak in the United States. Journal of Poverty 14 (2023): 1-21.

- Mohammadi H, Ronaghi M, Shahnoushi The Effects of Governance Indicators on Per Capita Income, Investment and Employment in Selected Mena Countries. Iran. Econ. Rev 21 (2017): 211-229.

- Ronaghi M. Effects of Covid-19 on Iran’s Livestock and Meat Market. J. Agr. Sci. Tech 24 (2022): 1017-1029.

- Antipova A. Analysis of the COVID-19 impacts on employment and unemployment across the multi-dimensional social disadvantaged areas. Social Sciences & Humanities Open 4 (2021): 2-24.

- Gautam S, Setu SH Golam M, Khan Q, et al. Analysis of the health, economic and environmental impacts of COVID-19: The Bangladesh perspective. Geosystems and Geoenvironment 1 (2022): 1-11.

- Filonchyk M, Hurynovich V, Yan H. Impact of Covid-19 lockdown on air quality in the Poland Eastern Europe. Environmental Research 198 (2020): 110454.

- John E. Anderson. UCLA Anderson School of Management. US News (2022).

- Granger CWJ. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37 (1969): 424-438.

- Komijani A. The effect of inflation on income distribution and the performance of compensatory policies. Journal of Economic Studies and Policies 69 (2014): 1- 24.

- Dickey D. Stationarity Issues in Time Series Models. Statistics and Data Analysis 10(2016): 1-17.

- Chen H. Nominal GDP targeting, real economic activity and inflation stabilization in a new Keynesian framework. The Quarterly Review of Economics and Finance 78 (2020): 53-63.

- Tunc I. CO2 responsibility: An input-output approach for the Turkish economy. Energy Policy 35 (2006).United Nations, Adoption of the Paris Agreement. Energy Policy 35 (2015): 855-868.

- Dallari P, Aribba A. The dynamic effects of monetary policy and government spending shocks on unemployment in the peripheral Euro area countries. Economic Modelling 85 (2016): 218-232.

- US treasury (2021).

- Chandrarin G, Sohag K, Sukanti K, et al. The response of exchange rate to coal price, palm oil price, and inflation in Indonesia: Tail dependence analysis. Resources Policy 77 (2022): 27-50.

- Zubaira A, Oluwaseyi A, Samad A. Does gross domestic income, trade integration, FDI inflows, GDP, and capital reduces CO2 emissions? An empirical evidence from Nigeria. Current Research in Environmental Sustainability 2 (2020): 1-9.

- Rahman M, Alam K, Velayuthama E. Reduction of CO2 emissions: The role of renewable energy, technological innovation and export quality. Energy Reports 8 (2022): 2793-2805.

- Ronaghi M, Reed M, Saghaian S, et al. THE IMPACT OF THE AGRICULTURAL SECTOR IN DEVELOPING COUNTRIES THAT PRODUCE NATURAL GAS ON GREENHOUSE GAS EMISSIONS. International Journal of Food and Agricultural Economics 6 (2018): 53-69.

- Billi R. Unemployment fluctuations and nominal GDP targeting. Economics Letters 188 (2020): 89-70.

- Wen F, Zhang K, Gongd X. The effects of oil price shocks on inflation in the G7 countries. The North American Journal of Economics and Finance 57 (2021): 13-91.

- Nusair S. Oil price and inflation dynamics in the Gulf Cooperation Council countries. Energy 181 (2019): 997-1011.

- Papapetrou E. Oil price shocks, stock market, economic activity and employment in Greece. Energy Econ 23 (2001): 511-532.

- Zhao L, Zhang X, Wang S, et al. The effects of oil price shocks on output and inflation in China. Energy Econ 53 (2016): 101-110.

- Hamilton JD. Oil and the macroeconomy since world war II. J. Polit. Econ 91 (1983): 228-248.

- Marzieh Ronaghi, Mohammad-Hossein Ronaghi. Investigating the Impact of Economic, Political, and Social Factors on Augmented Reality Technology Acceptance in Agriculture (livestock farming) Sector in a developing countries. Journal of Technology in Society 67 (2021): 17-39.

- Oksuzler O, Ipek E. The effects of the world oil price changes on growth and inflation: example of Turkey. Zonguldak Karaelmas Üniv. Sosyal Bilimler Dergisi 7 (2011): 15-34.